What Did Amazon Do This Week?

AMAZON NOT COOL WITH Q3

Solid earnings, but a very choppy week for our favourite cardboard abuser…

Subscribers get to read the +30 other stories that Amazon got up to last week and analysis of what everything means for them ↓

Amazon’s Q2 2024 earnings give the company some breathing room amidst increasing competition, a poorer consumer and some other areas of concern like now being liable for faulty goods that Amazon sells. First the good news, net sales increased by 10% year-over-year, reaching $148.0 billion, compared to $134.4 billion in Q2 2023. Domestically sales are up 9% to $90.0 billion, while international segment sales rose by a more modest 7% to $31.7 billion. AWS remains a crowd pleaser with +19% year-over-year increase, reaching $26.3 billion. Ads drew in+ $12 billion, up 20% year-over-year, so don’t expect to have an easier time finding what you want or for Prime Video to lose any ads anytime soon. Why? These numbers represent the slowest-ever growth rate for the ad side of the business since Amazon started separating out the numbers about 24 months ago:

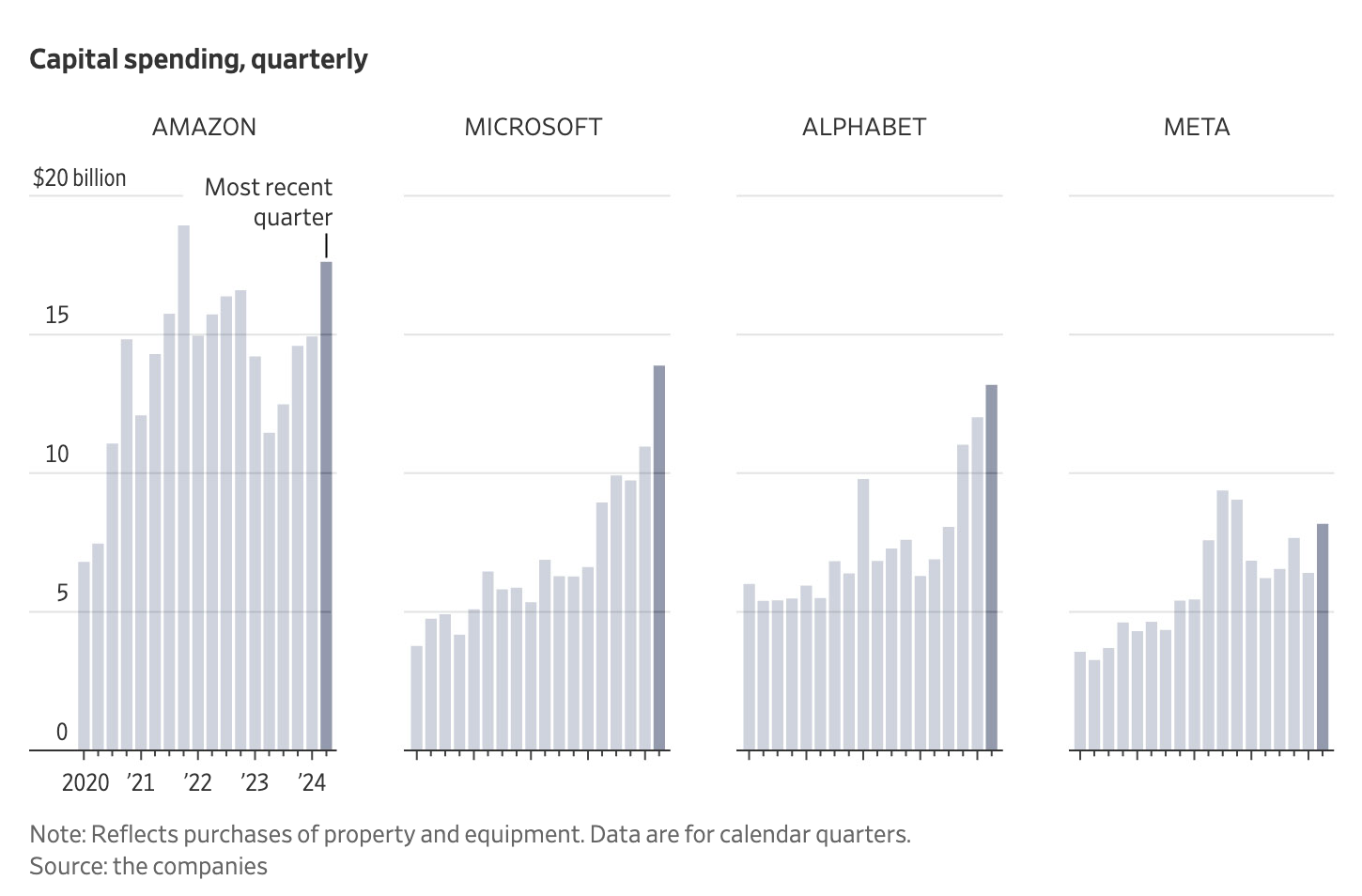

Operating income more than doubled to $14.7 billion, and the international segment achieved a $0.3 billion operating income, reversing a $0.9 billion loss from 2022. Amazon’s 10th Prime Day was their largest ever, and Prime benefits drew more Prime subscribers, but it pails in comparison with AI growth and cutbacks money. Health focused parts of the business could be even brighter stars in the future, if Amazon really gets their arses in gear. Amazon remains retail, services supporting that retail, and AWS and it’s spending hard on the latter:

The big news was a poor Q3 warning, but save the tissues and tears, Amazon is predicting sales between $154-8.5 billion. International sales will be a concern for some, and the dependancy on AWS will likely remain on the threat and opportunity columns on risk matrices for a while as market conditions could change (i.e. an AI cool down or regulation). Also, there’s a lot of macroeconomic factors including foreign exchange fluctuations, and geopolitical conditions could impact future performance. Remember, Trump is no friend to Amazon and Kamala is vocal on the monopolistic tendencies of Big Tech companies (although gets big tech’s importance to US’s future/bottomline).

SO WHAT?

Start thinking about Q4 and Q1 2025 carefully as Q3 will likely be a bust thanks to the Olympics, the US election, geopolitical uncertainty and general economic woes after the summer spending comes crashing back down to reality. Amazon is still being tight lipped if there will be another Prime Day sale in Q3.

Sellers and Retailers will need detailed strategies to capitalise on Amazon’s plans and needs to make more money to keep up appearances. AI-driven dynamic pricing models will help, but there will need to be more than just optimisation to bring home the bacon. Start thinking about Sponsored Brands ads along with DSP for targeted campaigns in addition to loyalty moves.

AI will be more and more of Amazon’s earnings in the future; expect a lot of focus on agentic AI and chatbots to come for consumers and customer support functionality. Retailers need to think hard about how they use Amazon this holiday period and not the other way around. How do they effectively integrate online and offline? Can businesses realistic handle BOPIS and curbside pickup? Evaluating the reliance on Amazon is never a bad way to spend your time. Nor is focusing on loyalty right now; think about personalised rewards, pre-sales and real-time inventory visibility to maximise sales and customer satisfaction.

Amazon’s ‘Mr Beast’ project came under fire this week about conditions and past comments the host himself made. /Variety + /Deadline

Twitch remains unprofitable a decade after Amazon's acquisition; Docs show Twitch generated ~$667M in ad revenue and $1.3B in commerce revenue in 2023. /WSJ

(No surprise) Twitch staff are worried about downsizing. /Metro

Prime Video ordered a series about romantic novel ‘Every Summer After’. /Deadline

Amazon MGM won the auction for hot book 'Yesteryear'. /Deadline

AWS made 36 announcements this week. /AWS

Amazon announced an AI upgrade for ‘Just Walk Out’ technology. /RetailDive

Amazon has discussed a 'DoctorAI' tool to automate routine healthcare tasks. /BI

Amazon was projecting healthcare loses, but sales surprised execs. /BI

Amazon is deprioritising S3 Select, CloudSearch, Cloud9, SimpleDB, Forecast, Data Pipeline, and CodeCommit. /BI

Amazon is now liable for sale of hazardous third-party products. /Reuters

Amazon heavy and bulky item (weighing 31.5 kg or more, or whose longest side when packed exceeds 175 cm) returns will now require home collection from 30th August. /ChannelX

Amazon is expanding its one- to two-day delivery capabilities to US rural areas, using hyper-efficient warehouses, contracted drivers, and mom-and-pop shops. /WSJ

Amazon reminded Sellers to get Labour Day Sale (Aug 26) offers in. /ECB

Jeff Bezos’ family office is making big investments in AI. /CNBC

Amazon is is suing Nokia over cloud computing patents. /Reuters

Amazon announced solid Q2 2024 earnings. /Amazon

Amazon received criticism from anti-semitism whistleblowers. /Telegraph

Amazon’s leadership principles under Jassy received scrutiny. /Fortune

Amazon is now liable for any faulty goods it sells on its marketplace. /CNBC

Amazon announced weak Q3 2024 guidance. /Amazon

Jeff Bezos lost +$15 billion in personal wealth because of the Amazon stock slide. /Bloomberg

Amazon is sniffing around the (terribly named) vacuum maker called ‘Covariant’. /Bloomberg

Amazon shares tumbled after third-quarter outlook disappoints. /CNBC

Temu and Shein’s soaring popularity has Wall Street eyeing China’s influence on tech earnings. /CNBC

Temu faces backlash from its Chinese suppliers over its aggressive effort to recruit Amazon merchants who hold goods in warehouses in the US and the EU. /FT

Here’s the robot that is making Amazon’s solar farms. /YouTube

Walmart's low price promise in focus after Amazon's warning. /Reuters

WD_DTW currently covers two other companies changing the world; OpenAI and now Google. Each offers unmissable intel for savvy businesses with weekly deep dives, critical analysis, saving you tons of time. Available in monthly and annual subscriptions, cancel anytime. Subscribe today; here for OpenAI and here for Google.